A financial model helps businesses to make better choices quickly, confidently and accurately.

A financial model helps businesses to make better choices quickly, confidently and accurately.

Financial models are predictions based on informed assumptions on the behavior of key internal variables. These include expenses, revenue and working capital. These all impact on the overall business fundamentals.

Usually financial models are spreadsheet-based tools that helps translate abstract representations of real world financial situations, such as asset prices.

They also provide insights into market directions from processed data, which are important for scenario analysis and, as part of a management tool to track KPIs, metrics, and other key data points relevant to a business.

Uses of financial models are wide and varied, and include:

It is important to state that the quality of a model depends largely on the quality of the assumptions made about the economic drivers of a business. Therefore, the judgement of the financial modeler is important when determining and weighting variables that will most accurately reflect these assumptions.

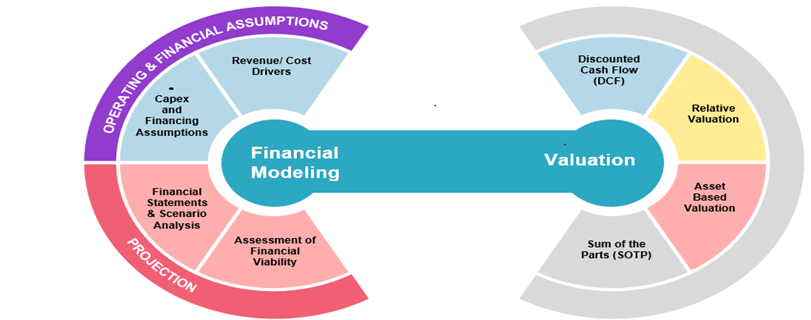

Schema showing how financial modelling is applied in business valuation

There are a number of skills that should stand out, such as having:

Financial modelling is, however, an art and science. Numbers and trends can be predictable. At the same time, informed judgement and a bit of intuition gained from experience is required for an effective insight into the financial future and value of an organization.

Sources:

https://www.bloomberg.com/opinion/articles/2019-04-08/financial-models-are-not-a-substitute-for-good-judgment

http://ncsp.org/exactly-financial-modeling/

https://fitceo.com/business-and-financial-models/

https://www.cleverism.com/financial-statement-analysis-introduction/

https://www.edupristine.com/blog/benefits-financial-modeling-course

first of all, I would like to thanks a lot for writing such an informational blog about FINANCIAL MODELS.I got here, what I wanted about digital marketing

Interesting Things.