Swiss real estate remains one of the safest asset classes in the world. Legendary stability, steady price growth, strong rental demand, and an exceptionally protective legal framework: on paper, everything seems ideal.

However, for foreign investors, the reality is more nuanced. Below is a comprehensive analysis and perspective—covering advantages, pitfalls, and 2025 figures.

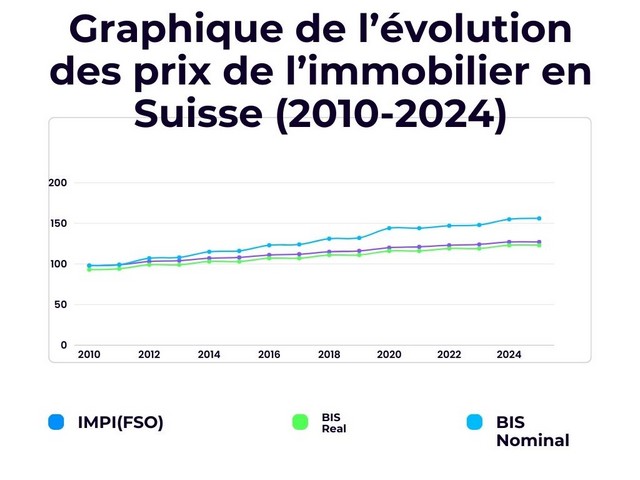

According to Wüest Partner (Indice 2024), between 2010 and 2024, prices for owner-occupied apartments (PPE) increased by 54%, while prices for single-family homes rose by 63%.

When examining the chart showing the evolution of real estate prices in Switzerland, it is clear that the market experienced steady and continuous growth between 2010 and 2024.

There are no sharp fluctuations, sudden drops, or periods of high volatility—which is precisely what makes this market so attractive for long-term investment.

Unlike countries where prices can vary significantly due to economic or political factors, Switzerland’s real estate market is characterised by:

a gradual upward trend,

low sensitivity to global crises,

a minimal risk of capital loss.

As a result, capital loss is virtually non-existent—a decisive argument for investors who prioritise wealth preservation.

Below are the average gross rental yields in 2025:

Zurich: 2.3–3.1%

Geneva: 2.6–3.4%

Lausanne: 3.0–4.0%

Peripheral regions: up to 4.5–5.5%

These returns are modest compared with Lisbon or Berlin, but Switzerland’s national vacancy rate stands at just 1.1%, the lowest in Europe. In addition, rental defaults are extremely rare thanks to Swiss rent guarantees (2–3 months’ security deposit).

In practice, once a property is rented out, it generates stable and predictable positive cash flow for decades.

This is the key restriction foreign investors must understand.

Without a B or C residence permit (Swiss residency), a foreign national cannot purchase:

✖ a single-family home

✖ a condominium apartment (PPE), except in very rare cases

✖ a secondary residence (unless under an extremely limited cantonal quota—often just 1–2 properties per year per municipality)

What a foreign investor can purchase freely:

✓ commercial properties (offices, commercial premises, retail units)

✓ shares in Swiss real estate companies (provided the company is domiciled in Switzerland and the end use is commercial)

✓ property via a Swiss company they control—the structure most commonly used by high-net-worth foreign investors

However, legal solutions do exist and are widely used—their accessibility varies significantly depending on the investor’s nationality.

They account for 65–70% of commercial real estate transactions by foreigners. They can freely acquire commercial property (offices, retail units, hotels, warehouses) as well as shares in Swiss companies with a commercial purpose.

For residential real estate, the most common approach is the creation of a Swiss company (SA or Sàrl) whose stated purpose is commercial (serviced residences, aparthotels, student housing, etc.). This is currently the fastest and most widely used structure.

The number of Asian investors has surged (+240% in five years). They invest freely in commercial real estate and heavily in listed real estate funds.

For residential property, the preferred route is obtaining a B residence permit via lump-sum taxation, often in the cantons of Valais or Vaud, with an annual minimum tax base typically ranging from CHF 400,000 to 800,000.

Thanks to bilateral agreements, EU and EFTA citizens can purchase property under the same conditions as Swiss nationals, with no restrictions—whether for houses, apartments, or secondary residences.

They represent around 80% of total foreign purchases, mainly Germans and French buyers in border regions and Alpine resorts.

These investors have the same rights as Russian or Asian investors regarding commercial real estate and funds.

For residential property, they typically invest via a Swiss company or through lump-sum taxation, which is particularly popular among Gulf families in Verbier, Gstaad, or Andermatt.

Conclusion: a determined and well-advised foreign investor will always find a legal entry point. The key is choosing the right legal structure from the outset, with the support of a specialised lawyer or notary.

A tax system that is less daunting than it seems

Key taxes to consider in a Swiss real estate transaction include:

Net of tax, a well-structured foreign investor (Swiss company + mortgage financing) often achieves a net yield of 2–3.5%, combined with capital appreciation of 2–4% per year—for a total annual return of 4.5–7%, with very high security.

Swiss real estate is not designed for investors seeking quick 10% returns.

It is ideal for those looking to:

If you are willing to accept moderate returns in exchange for maximum security and steady capital appreciation, Switzerland remains one of the world’s best choices in 2025—provided the legal structure is carefully selected.

Sources:

Image: ©Bdesign28 - 817212778

Spécialiste des investissements alternatifs, je mets en perspective immobilier et objets de luxe pour décrypter les tendances d’aujourd’hui et de demain. Pendant dix-sept ans, j’ai exercé comme agente immobilière en Ukraine, où j’ai développé une expertise approfondie du marché local, en particulier dans la sélection d’appartements et de maisons pour des investisseurs souhaitant préserver ou faire croître leur capital. Habituée à travailler avec une clientèle internationale, je maîtrise à la fois les spécificités locales, les stratégies d’investissement, les critères de rentabilité et l’analyse des risques. Installée aujourd’hui en Suisse, j’ai élargi mon champ d’expertise à l’univers des montres, de la joaillerie et des objets de luxe. Sollicitée pour des conseils dans ces domaines, j’ai étudié les grandes maisons, la valeur des matériaux, l’évolution des prix et les dynamiques propres au marché du luxe. Je propose des analyses accessibles, concrètes et orientées vers la prise de décision, en tenant compte des atouts, des risques et des spécificités de chaque forme d’investissement.