Every January, it is the same story. The tax declaration form arrives in the post. It must be completed and sent back before the end of March. There is no need though to get stressed. There is an easy way to do it. Just follow our tips!

Firstly, you need to gather up and organize all the documents from the past year that will be used to complete your tax declaration.

Firstly, you need to gather up and organize all the documents from the past year that will be used to complete your tax declaration.

Take a binder and name it ‘Tax Declaration 2016’. Use dividers with the following labels:

These are the basic documents for your tax declaration. Do not let the work build up, but collect the necessary papers during the year and file them as you go.

An example:

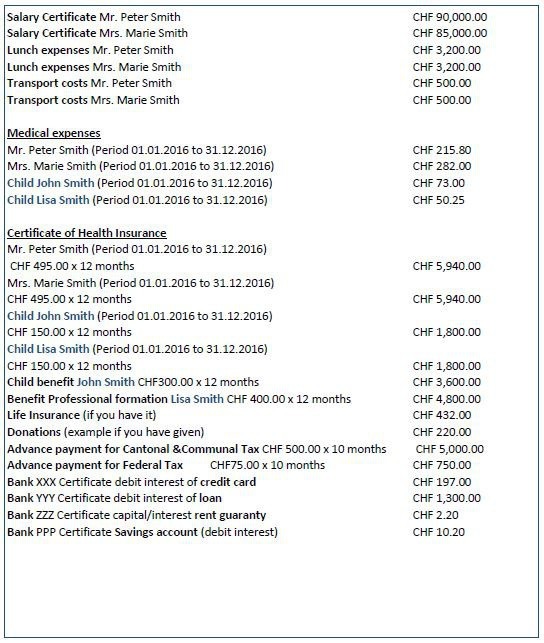

To illustrate this, below is an example of a someone preparing their ‘Tax Declaration 2016’ for a family of 4; a father, mother, son (10 years old) and a daughter (16 years old).

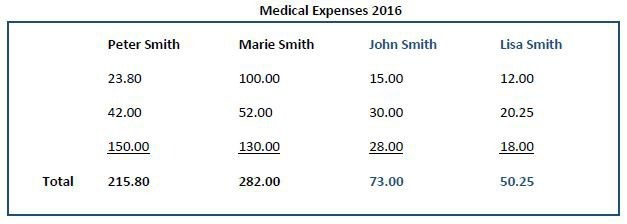

In the example below, we have distinguished the parents and the children with different colors for clarity: Peter Smith Marie Smith John Smith Lisa Smith

That way, each time you receive an amount that you need to pay, you can highlight with the same color the amount and the name of the person related to the expense.

You should file the original salary certificate, normally received during the month of January, and make a copy of it (for both the wife and husband if required).

It is good have all the medical expenses collected, as these are tax deductible. Each time you receive expenses from the health insurance company, include them in an Excel sheet for each member of the family (please see link at end of article for a tutorial on Excel).

You can use the excel sheet to register all the amounts that have been charged per insured person, including doctor’s appointments, controls at the hospitals and medication costs.

You also need to present the original invoices to the health insurance company. They will reimburse a percentage of the invoice. Do not forget to make copies of all the original invoices because you will need to attach them to the tax declaration.

Depending on your types of insurance, the certificates from the health insurance company should include:

The medical insurance certificate shows the amount you paid each month, and can be deducted from your tax.

The child benefit (allocations familiales) is considered an income and therefore should be declared. For a child under 15 years of age, the amount is CHF 300. For children 16 to 25 years, it is called “Allocation de formation professional,” and is CHF 400 per child. It should be noted that you receive these latter funds as an income only if your son or daughter is studying at a commerce school, college or in an institute.

The life insurance certificate shows how much you paid per year. You need to make a copy for the binder.

In case you have made donations, keep a track of the payments in your binder, as they are deductible.

Also keep a track of all the advance payments for Cantonal and Communal Tax/Federal Tax you have made to the tax authorities.

You need to request from your bank the following information if they don’t send it to you automatically:

Babysitting costs: All the receipts that you have paid to the ‘maman du jour’ and ‘crèche’, should be kept and filed in your tax declaration binder, and can be tax deductible.

Maintenance allowance is also deductible from the tax declaration for divorced couples.

The mode of transport from home to work is also tax deductible. If your company does not pay for your transport, keep the TPG tickets as proof.

If you are unable to have lunch at home, because of the distance and lunch time hour, and you have to stay close to the office you can deduct CHF 3,200.00 per year.

You have the right to deduct from your taxes for each child CHF 6,500.00 from the Federal Tax.

Prepare and file all documents needed for your tax declaration during the year. I would also contact a fiduciary to help complete your tax declaration. They know a lot, and are up-to-date, about new laws and expenses that can be deducted.

Normally, the cost for a simple declaration is CHF 95 and for a couple, CHF 105.

The fiduciary will request some original documentation that needs your signature and then sent to the tax authorities.

For this reason, it is a good idea to make copies of the following:

Below is an example of a financial summary to present to your fiduciary.

Also attach all the documents required to your declaration, and keep a copy of them for your records.

Also attach all the documents required to your declaration, and keep a copy of them for your records.

I hope this advice helps in preparing your next tax declaration. Any comments and suggestions are always welcome.

For a tutorial on using Excel, see http://chandoo.org/wp/excel-basics/